I recently interviewed with a top fintech in India for their Product Manager role. As part of my interview, I worked on a case study for the problem statement given by the company. I have replaced the company name with BankNow. Apart from the brief problem statement, I had received a separate note on what they wanted me to include in this case study.

The given Problem Statement:

BankNow is a novel fintech that is trying to launch a neobank. A neobank is a 21st-century bank that doesn’t have any physical branch. You can read up more on what neobanks are here — https://en.wikipedia.org/wiki/Neobank

BankNow is trying to create a salary account offering for the gig economy workers in India. They want this to be deployed in the form of an android app. The motive of this app is to become a hassle-free, powerful, defacto salary account for these employees.

BankNow is seed-funded and has just raised $2 million from Famous Ventures. They have a team size of around 10 people based in Bengaluru and have raised funding basis their idea. The tech team size is about 3 backend + 2 frontend developers (1 web + 1 mobile)

Let’s begin with a few concepts that I will be using often in this case study.

Neobanks and Traditional Banks

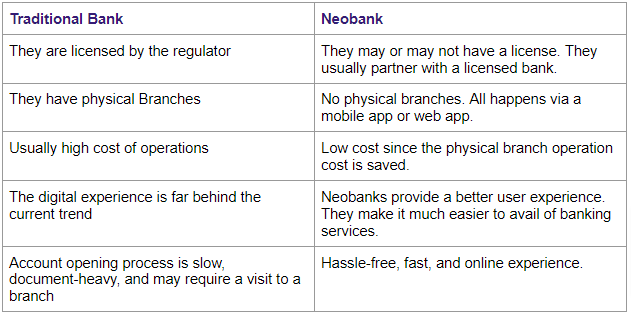

Traditional banks are the entities that hold the licenses to operate a full-fledged bank with credit products, cards, lending products, and have a physical presence.

In contrast to that, Neobanks offer banking services via an online interface and have no physical presence. In fact, a few Neobanks do not have a license like a traditional bank, hence, they partner with a traditional bank.

Few key distinctions between the two:

Gig Economy

A technology platform that connects a service provider with the service seeker. In this case, a service provider is a gig worker who can do that task. Examples: Delivery executives, cab drivers in ride-sharing apps, independent contractors for consumer services on platforms like Urban Company. Typically, this is not a conventional job where the employer takes care of most things like provident fund, health insurance, salary account provided, etc.

Opportunities

- Requires minimum, low skill-set

- Quick employment option

- Education is not a deterrent

Risks

- Job security

- No employment contract hence labor laws may not always cover them.

- Very limited banking services like loans.

Salary Accounts and regular accounts

Salary accounts, when compared to a regular savings account, have the following advantages:

- Zero balance account. No Monthly minimum balance required.

- No fees charged for not maintaining an average monthly balance.

- Card issuance is not charged. A debit card is typically given for free.

- No extra charges on the transfers or payments.

- A credit card with income-based limits is given for 1 or 2 years for free.

- Access to other financial products like Mutual Funds etc without much due diligence.

- Interest on the account balance.

Why is this context important?

Opening a bank account with a traditional bank is slow, requires heavy documentation, and tends to deny banking services to a gig worker because of their nature of work which comes with a certain risk.

User Persona

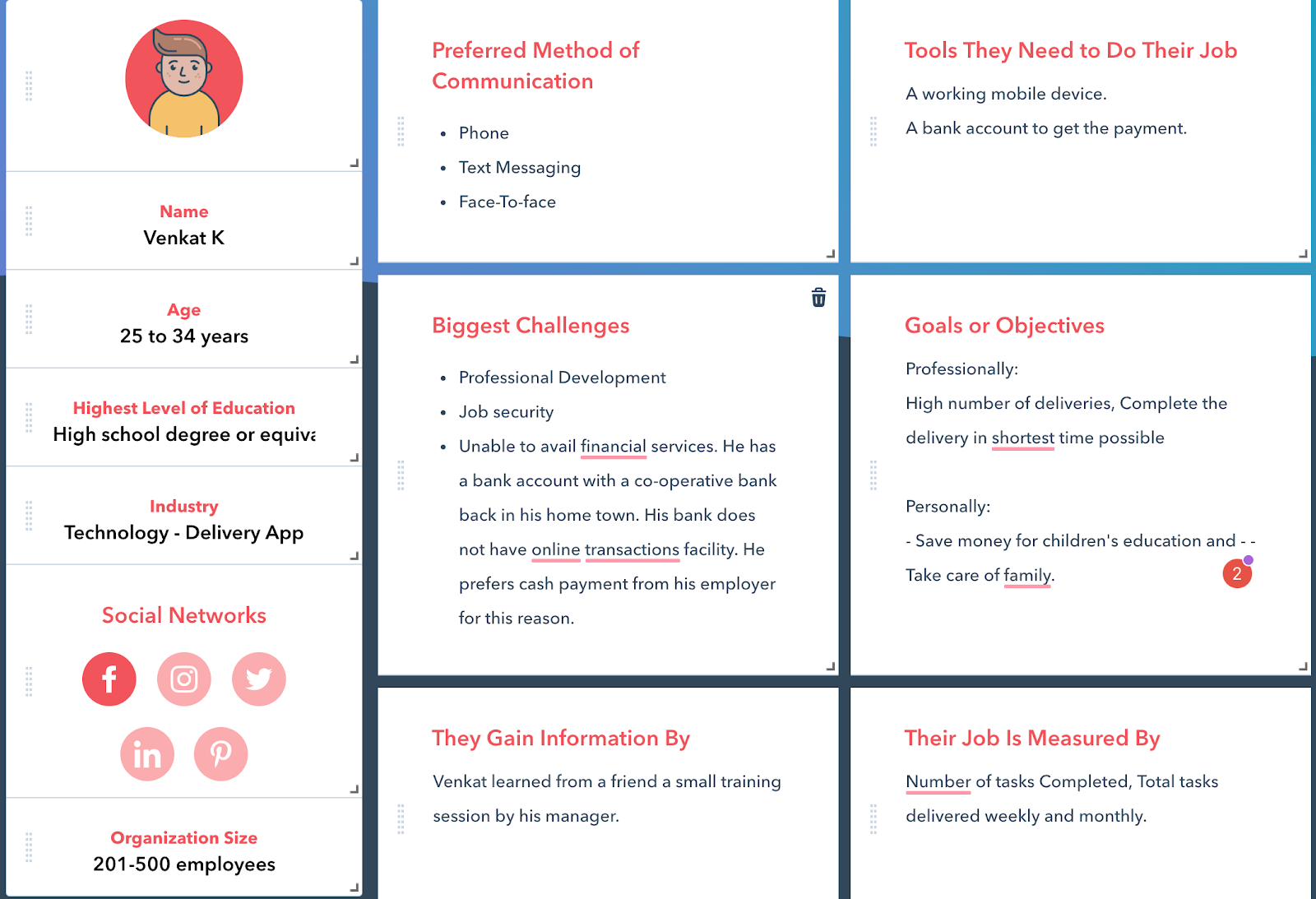

Venkat K

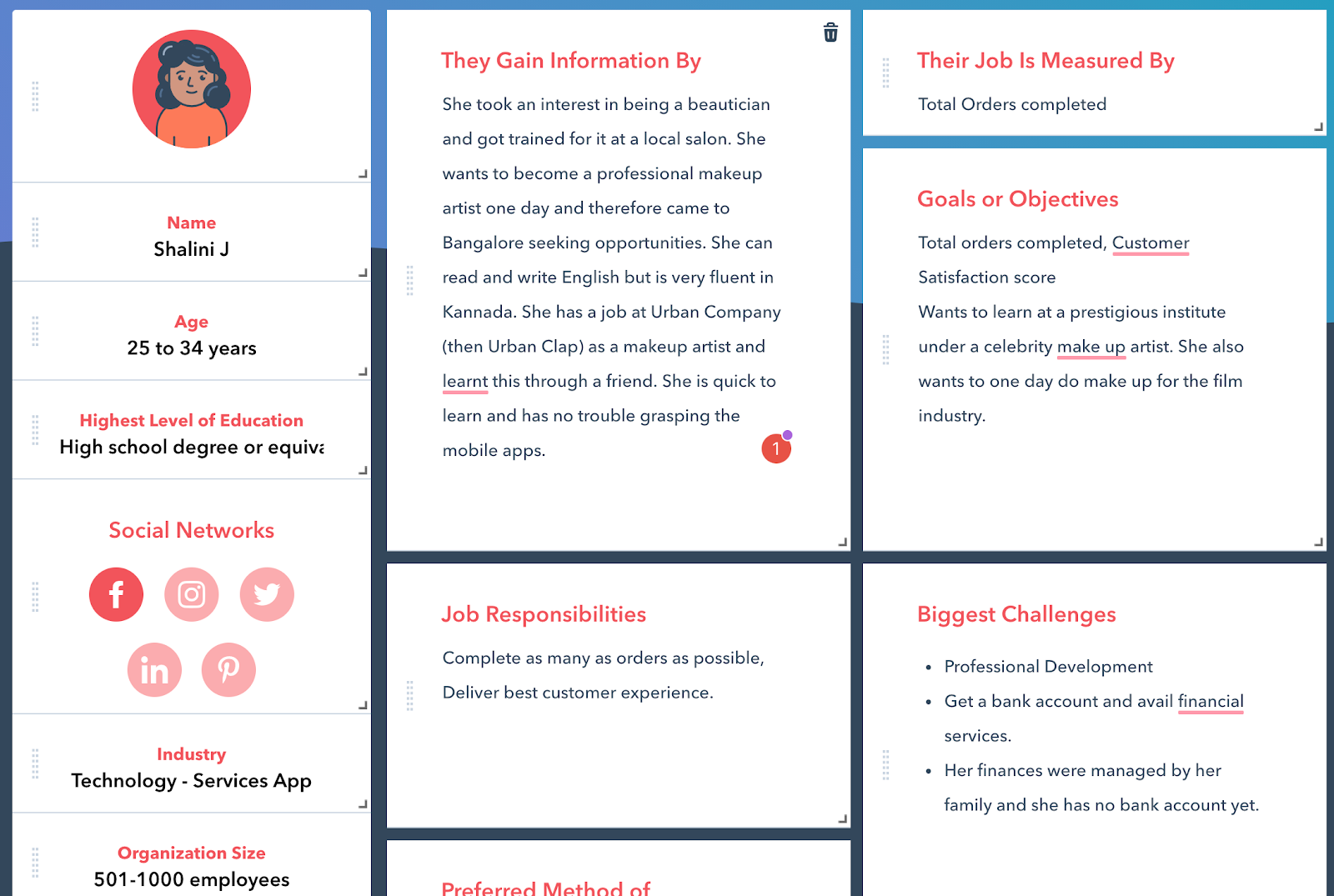

Shalini J

Objective

To give access to the best banking and financial services to the gig workers by means of providing a bank account with salary account benefits and other banking services hassle-free via a mobile application.

Market Sizing

Globally, the gig economy is expected to grow to ~USD 455Bn by 2023. Ref.

Also, the neobank is on the rise since it is expected to grow to approx. USD 400Bn by 2026 globally.

But the Indian market with a labor force in the urban areas is estimated to be 35 Mn and growing.

To give perspective, UrbanCompany alone has grown from 3 Cr in FY16 to 142Cr in FY20 in revenue. Currently, they have 25,000 professionals or Gig workers on the platform. Ref.

These are the indicators of rising gig workers and an opportunity for the product.

Competitive Analysis

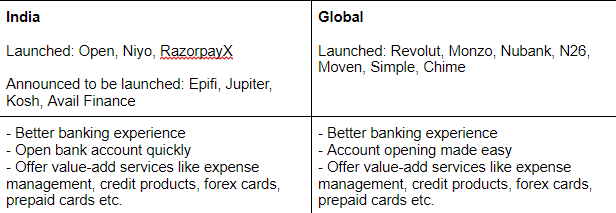

The landscape for both the Indian and the Global players is almost similar whereby they challenge the existing banking experience, provide a better user experience, and bundle the value-add services to the customers.

With all companies above funded heavily for their operations, it is apparent that neo-banking is definitely on the rise in India. This indicates an opportunity for the company to pursue this product.

Scope

– The gig economy is large and for the purpose of this case study, I am considering service providers like delivery executives and home services executives.

– This case study will include the account opening experience for any gig worker who wants to get a bank account instantly.

– For the purpose of this case study, I will cover the Indian market only.

– The wireframes are done by keeping Android in mind. iOS platform is part of the product roadmap section.

Assumptions

– BankNow operates under the license of a partner bank since there are no specific guidelines by RBI on neobanks. Ref. In case the company holds the license, it will not have any significant impact on the user journey.

– Users are connected to the internet, possess a mobile device with Android OS.

– The current products available in the market are inadequate compared to the rising demand in terms of experience and service.

Proposed Solution

A digital bank account for the gig economy worker for a salary account available on the mobile application.

Following are the key aspects that can be focussed on:

- Onboard the user in the shortest time: Online KYC with minimum steps to get access to the account.

- The instant virtual card on the account to get started on the usage.

- Physical cards for the ATM withdrawals.

- Attractive interest, No hidden fees.

- No minimum balance commitment.

- Account Management:

- — Check the balance in the app

- — Transfer money to friends and family from the app

- — Manage and Control card from the app.

- Finance Management

- — Check your spends

- — Categorize your spending and see if you are overspending.

- — Receive important notifications over Whatsapp.

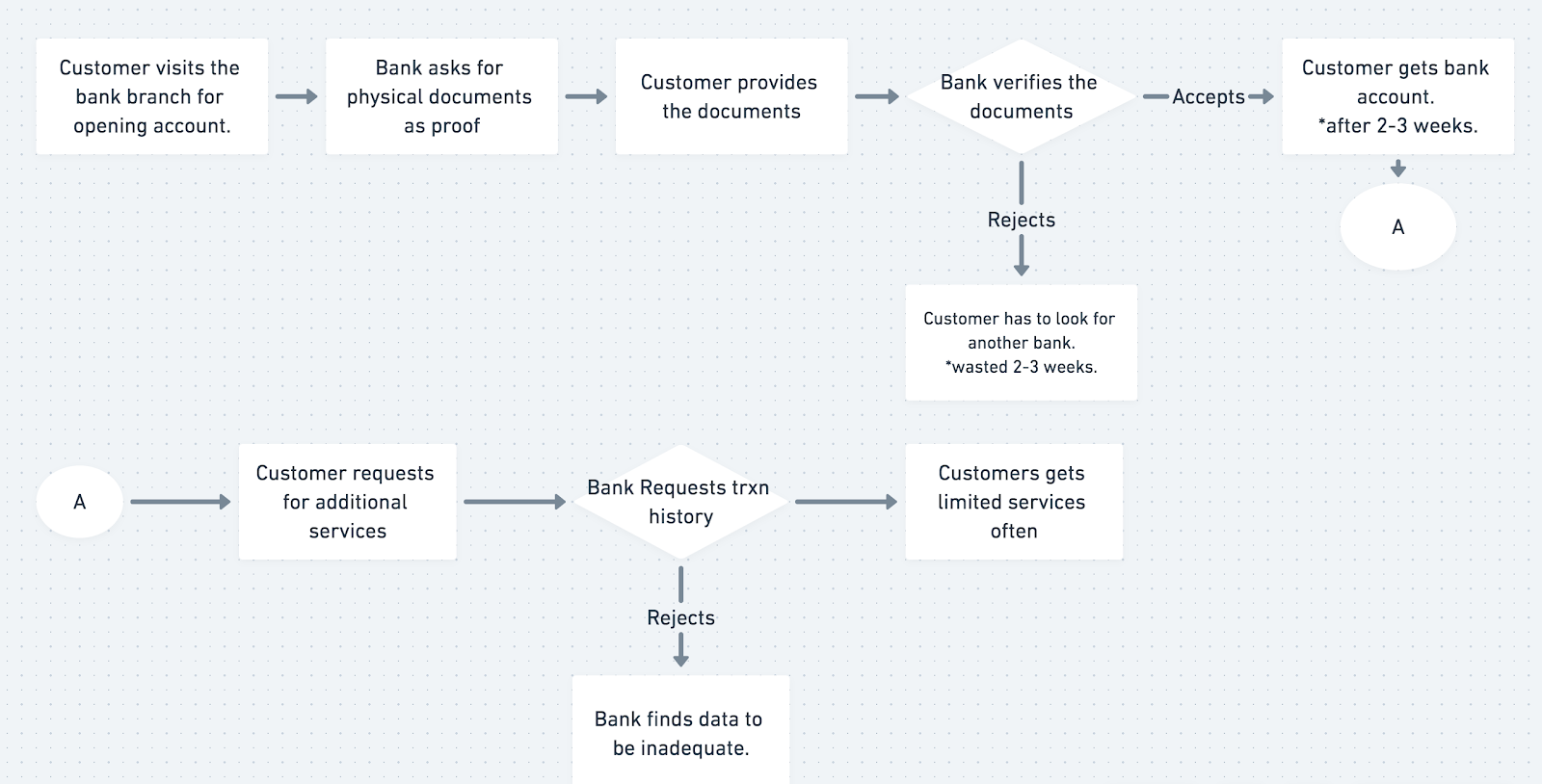

Traditional Bank account opening flow:

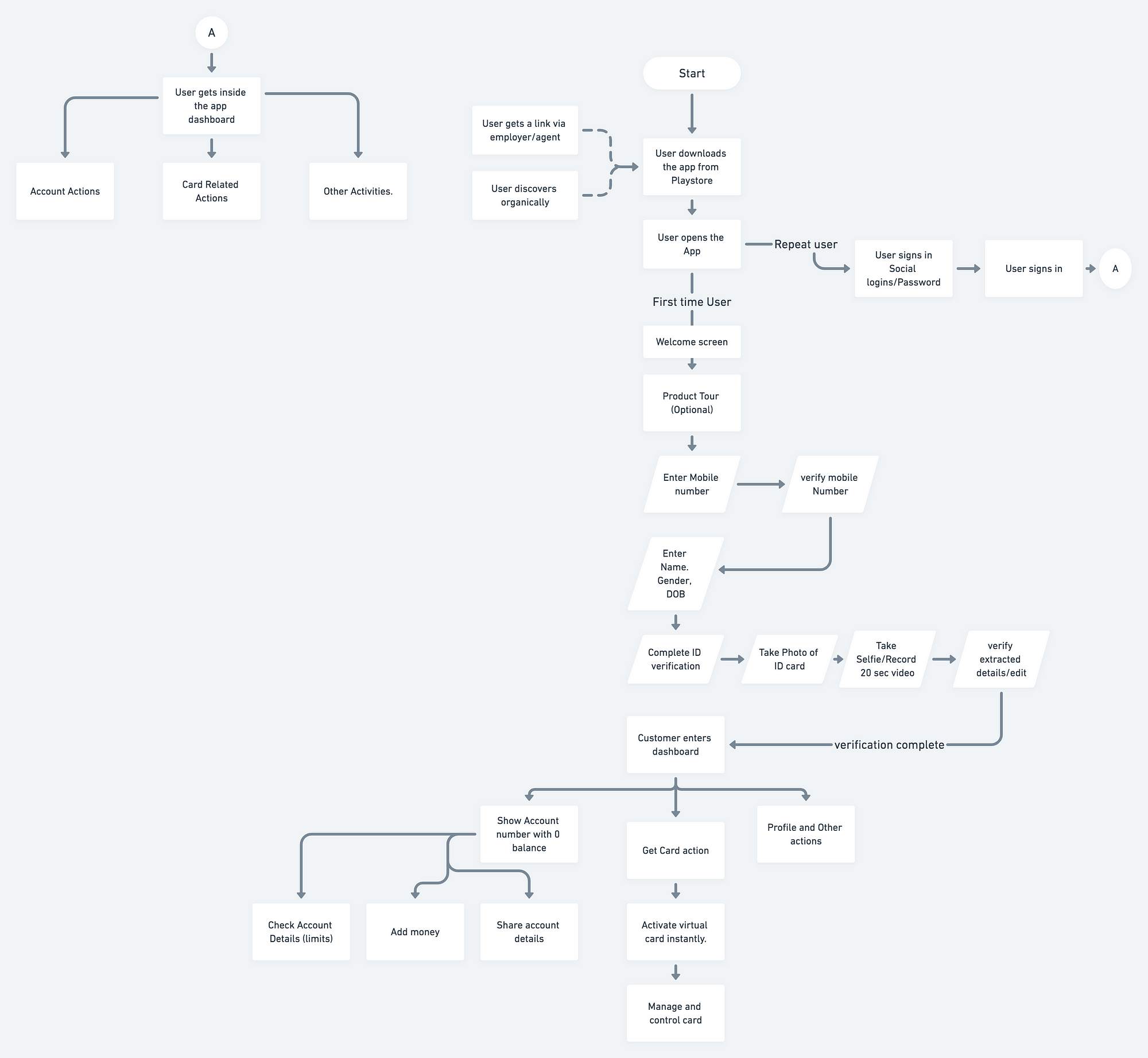

Proposed Solution for the BankNow Account opening:

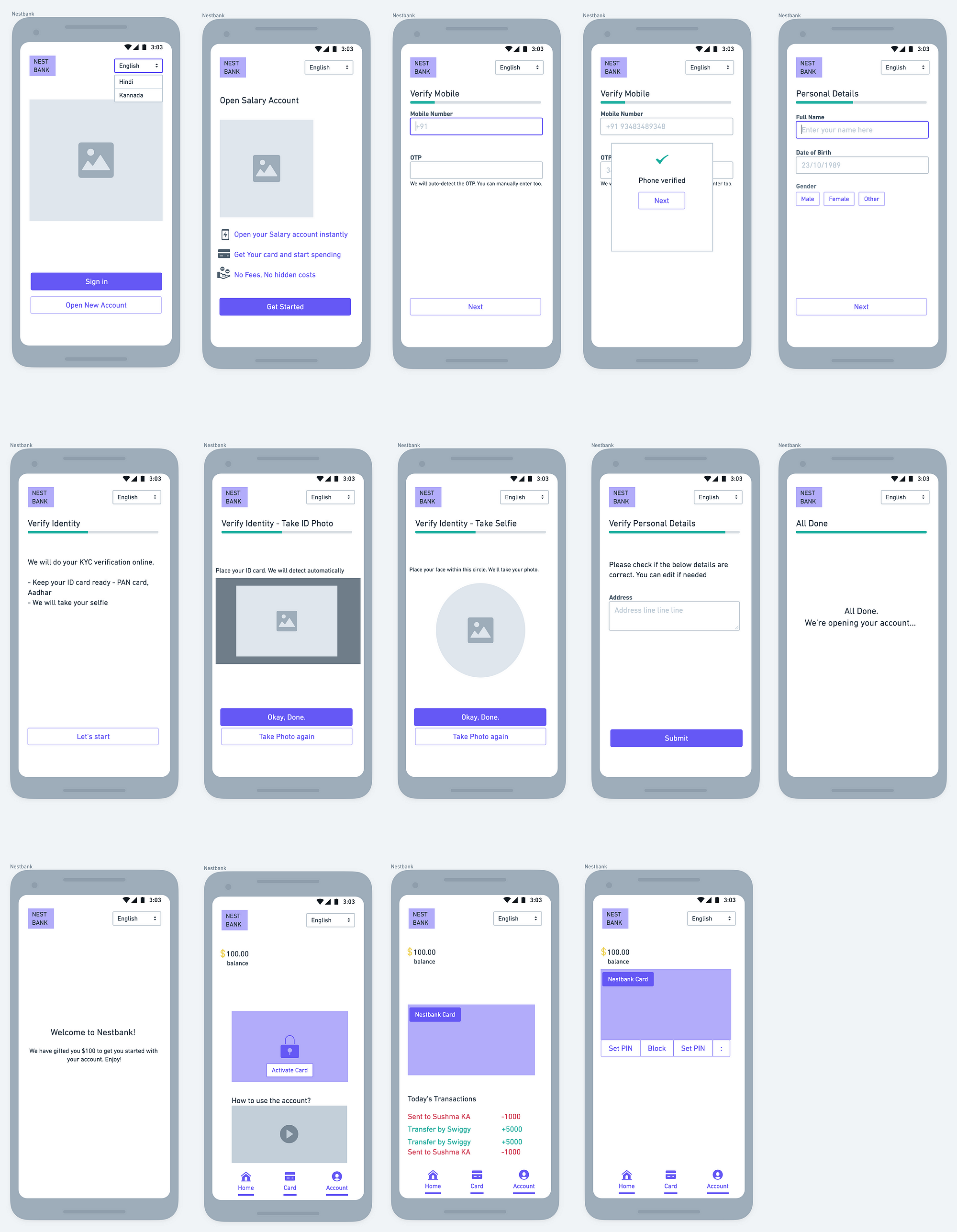

Wireframes for the user’s journey:

Product Marketing Note:

While the actual copy for this note will depend on the product marketing team, these are the possible ways to attract customers.

Customer Facing Copy:

- Having trouble getting a bank account? Are you getting drowned in the documents? BankNow has you covered. All you need is an ID card and we do the rest for you.

- Get your salary account within the blink of an eye. No more branch visits and no paper-work required!

- BankNow Salary Account is hassle-free and cost effective! Download the app Now.

For the Team:

We give traditional benefits of a salary account in the modern banking app! With millions of people joining the gig economy each year, it is difficult to ignore the gig workers. But these workers are underbanked, unable to avail of financial and banking services. They are constantly on the move and they need a bank partner that moves with them.

With BankNow’s neobanking solution, we offer Salary accounts to gig workers. Open accounts faster, get cards for spends and analytics, all on the mobile application. BankNow product aims to include gig workers in banking and financial services.

Go to Market Strategy

Launch with the mobile application to a specific segment.

- Closed Beta Launch — One partner with a limited number of customers. (Beta is required for eliminating the initial hiccups)

- Controlled public launch — Launch in tier 1 Cities. Partner with aggregators or gig job providers. Reason for tier 1 city — the gig workers are more likely to be tech-savvy and hence, faster adoption. In the first launch, target the likes of UrbanCompany, Swiggy, Runnr, and Dunzo.

- Public Launch — Target all cities in India.

Customer Acquisition

I have listed down the following possible channels for customer acquisition while acknowledging that the initial launch will potentially spread via word of mouth.

– Acquire users via partner tie-ups.

– Channel Partnerships — Vahan, Blue-collar enabling platforms, payroll companies.

– Partner with local banks. They can offer a digital banking experience and attract more users. Opportunity for them to onboard new customers with a better experience.

– Partner with local/national unions for the specific task force — Drivers have their Unions.

However, out of the above, I would prefer a partnership with the service platforms themselves like Uber, Swiggy, Dunzo, UrbanCompany, etc.

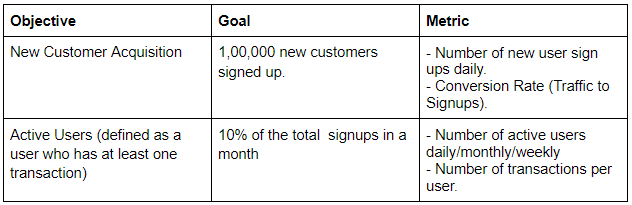

Metrics and Tracking

The goal of the Product: Acquire 1,00,000 customers in 1 year. (Includes beta launch)

The key Indicator will be Month on Month growth in new customers.

Product Roadmap

| At Launch (Jan 2021) | Mobile App Open salary account instantly with eKYC Virtual Cards |

| Phase 1 — (Jan — Mar) | Physical card order flow in the app. Local language support |

| Phase 2 — (Mar — July) | Rewards on card spends Spend Analytics iOS platform |

| Phase 3 — (July — Dec) | The first version of the lending product. |

Disclaimer: This case study is my personal work and in no way borrowed or copied. However, I did use the web and books for research and inspiration.

Leave a comment