I worked in Fintech companies for more than 4 years and selling payment gateways was my job. There is a lot to be said about the benefits of having a payment gateway but since you have landed on this article, let’s assume you already need a payment gateway. You may have even created an excel sheet to track various products, its features and pricing.

Let’s help you out further.

First things first, when I say Payment Gateway, think of Razorpay, Payu, Cashfree, Paytm etc. These companies typically work for small and medium sized businesses.

Here is a million dollar question then: Out of all the payment gateways, which is the right one for you?

An Indian mind might think, “cheaper is better.” That is not necessarily true. Of course, you want to keep your costs low but you don’t want to compromise on the quality and experience either. No matter which payment gateway you use, your customer will be directly impacted. The last thing you want is to deliver a poor payment experience to a customer who has chosen your product over millions of others.

I have laid out factors for your consideration during the evaluation phase.

My best tip is not to rush for the cheapest available option.

Payment methods – Domestic and International:

This is the first thing to check. Usually, all the payment methods are listed on the company’s website. You will notice Domestic and International methods of payment are listed separately.

My tip: Not all businesses automatically qualify for international payments. Verify ahead of time with the payment gateway’s team.

In most Payment Gateways, you will see standard payment methods – Debit card, Credit card, Net Banking, UPI, Buy Now Pay Later (EMI-based), Digital wallets like Paytm, Mobikwik etc.

International payment methods are usually limited to credit cards. If you have customers in other countries and they need payment via specific method, get it confirmed.

Suppose you are looking for a fairly new payment method, you can check with the team directly. Sometimes, they launch features in beta mode; meaning they make these features available only for select group of customers.

How to use the payment gateway

This factor is very important to understand because there are multiple ways to use the payment gateway. Typically you will see: Pre-built Checkout flow, Payment Link, API integration.

Here is a framework for you:

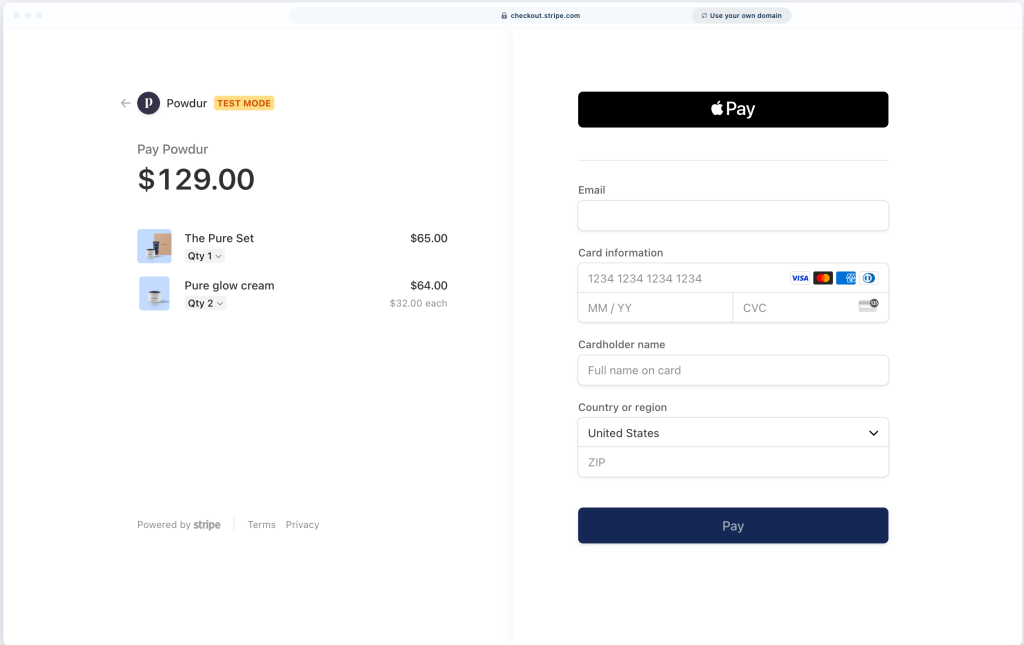

Small Business, No in-house technical (software engineers) team, few daily transactions (between 0-50) → Go for ready-to-use solution such as Payment Link or Checkout built by the payment gateway. For example, here is how Stripe’s pre-built checkout looks like.

Medium & Large sized business, has in-house technical team, substantial daily transactions (more than 50-100) → In this case, if you are simply testing the waters, you can use the ready-to-use Checkout flow at first, else go for the API integration. The advantage of a pre-built solution is that it allows you to validate your hypotheses and understand the customer needs. You can invest time in analysing whether customers are satisfied with the provided choices. Once you have enough validation for your usecase, you can go ahead with the API integration.

Time for account approval

Or as we call it “client onboarding time.” Every company is fighting for this metric – ‘how fast can I onboard the client’. Onboarding flow can be as easy as signing up on their website with basic company details or it can get as difficult as you having to submit tons of documents before you can even see the dashboard. Although, I will argue that most payment gateways have a very fast onboarding these days. Just ensure you have clarified this before selecting one.

Compliance requirements for your business type

Business registration is must. Even if you are an Individual selling products you could be asked for Sole Proprietorship registration document. There are some exceptions for personal use but as far as I know, it is either limited by access to features or the amount you can collect.

Have a bank account that matches the business registration document. This is where you will receive the money you collected from the customers.

Some businesses are not allowed to use the payment gateways or they have limited access to the features. For example, gambling business is not compliant with most payment gateways. This is ideally mentioned in the Terms and Conditions document. Alternatively, you can talk to their Sales Executive and find out if your business will be allowed or not.

I must admit one thing here, most Sales teams are incentivised to onboard as many new clients as possible so they may let this slide and not inform you properly but you should ask tough questions.

But why is this important? → Ongoing Due Diligence.

This is a kind of industry secret; perhaps not much of a secret to the people working in Fintech. Every payment gateway has a process of re-verifying businesses and their transactions on a regular basis. There is a chance your prior business approval may be rejected if some suspicious activity is detected. Hence, regardless of the initial decision, you can still face rejection.

When I worked in the Onboarding Team in Instamojo, I had daily requests from clients who wanted to get approvals for their businesses. If I noticed a risky type of business, I would explain the situation and politely decline.

My tip → just make sure you have stated the Purpose of Business as truthfully as possible and avoid deceiving the team.

Expected Transactions and its Volume

You should evaluate your own current or projected transaction data. In the Payment Gateway industry, we use 3 terms: Number of Transactions, Ticket Size (average amount per transaction), Transaction Volume. For example, you can have 10 transactions a day with an average amount of INR 1000 then your volume is INR 10,000. A distinction should be made between your Total Transaction volume and Transaction volume through payment gateways.

The only reason to consider this factor is for Pricing. If you push more transactions online, there is a cost to each transaction and you should be prepared.

My tip: If you have extremely high volumes, reach out to the Sales or Account manager and ask for discounted rates.

Pricing

Let’s talk money. Getting a payment gateway comes with a cost and often it is cost per transaction. You will see 3.5% on Credit Cards, 2% Debit Cards etc. This means if a customer buys your product using their credit card, you will have a cost of 3.5% on that transaction. Suppose the amount was INR 1000 and 3.5% is the cost, then you will receive (1000-35) = INR 965 in your bank account. The payment gateway deducts this cost before transferring the remaining amount to your bank account.

This is the time to evaluate how the cost of using a payment gateway. Some payment gateways offer you an option to pass the fee to the customer. In case you absolutely need this feature, then you need to look for it accordingly.

Payment Success Rate

Success rate can be defined in multiple ways but in this context, it means the number of payments that succeeded out of the total attempts. For example, if 2 customers tried to make the payment on your website and both payments succeed, you have 100% success rate.

The whole payment industry survives on 75-85% success rate. Anyone telling you 99.99% success rate is either ill-informed or trying hard to sell. However, this payment industry has come a long way. You will see higher success rates and faster payment flows.

Having said that, if you notice any reviews or data that confirms the poor performance of a payment gateway, then you should avoid them.

My tip → Check how the payment gateway handles failures and disputes from their knowledge base, online reviews, social media.

If you are evaluating Payment Gateway as a Product Manager, look at all the support documentation to identify failure handling processes. If you are a developer, then check their APIs for the error messages during failures. Mock the flows and check before going live.

These are some of the important factors that I recommend to consider. There can be several others but you can use these as a good starting point for the evaluation phase of payment gateway.

Here are some payment gateways in India that you can consider: