“Why should I worry about the pricing strategy?” I asked my manager during a conversation.

A bit of a story.

I had taken up the ownership of a newly launched product. While we had basic pricing model in place, we had to re-evaluate our pricing strategy for new market launches. My manager asked me to come up with a proposal. At first, I resisted because I always assumed it was someone else’s job. After a long conversation with my manager, in which he explained why should a Product Manager think about the pricing strategy. You are the best person to understand core offerings of the product and the customer problems it solves. Therefore, devising a pricing strategy or ability to propose a pricing strategy is very much part of the job.

That was my cue to start learning all about the pricing strategies and monetisation models. I bought the book Monetising Innovation by Madhavan Ramanujam and Georg Tacke. I watched countless videos on this topic from Y Combinator and other channels. I scouted the internet for any blog from startup founders and CPOs who had done this before. I was curious about both failure and success stories. I particularly remember an excerpt from Rahul Vohra’s interview. Link

While I could not contribute to the pricing strategy at my previous company, I got a chance to work on a case study during my interview with one startup in Amsterdam.

How to approach Pricing Strategy for Marketplace

In this blog, I am laying out my framework and the approach I took. I am not aiming to provide exact answers because the assumptions and hypotheses may be different depending upon the context.

Disclaimer: I cannot disclose the name of the company, so let’s call it Narnia.

Here is the case:

Narnia is a marketplace for buyers and sellers of agricultural goods. It is a new platform and has commitment from few customers to use it in the beta mode. Narnia wants to start with one or 2 products initially and then expand in different categories. Devise a monetisation model with hypotheses and validations. Monetisation model should include 1) Who to charge and 2) How to charge (pricing model).

Here is what I would do:

→ Understand the market and the players

→ Understand the core value proposition of the platform

→ Describe the pricing strategy and the model

→ State the hypotheses and validation methods

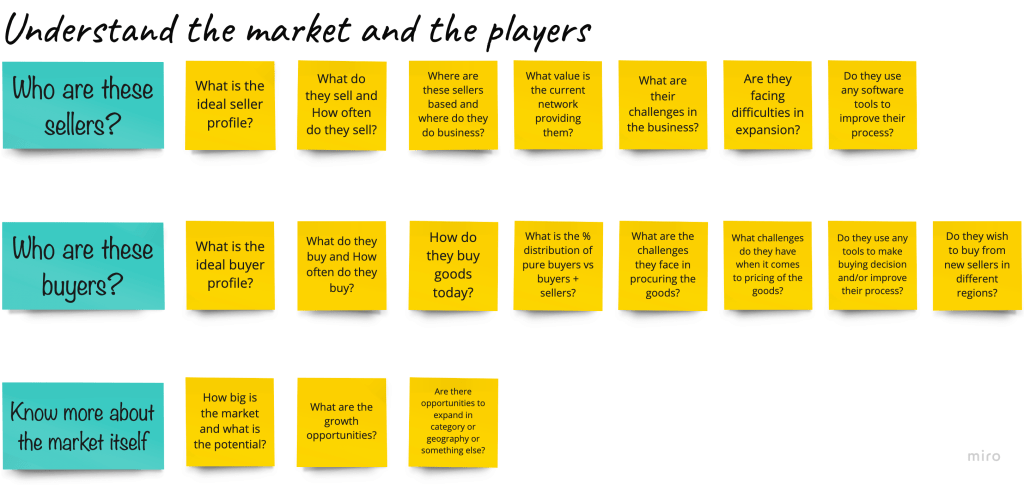

Understand the market and the players

Since we know this is a marketplace for sellers and buyers of the agricultural goods, let’s start with them. Find out more about them.

- Who are these sellers?

- What is the ideal seller profile?

- What do they sell and how often do they sell?

- Where are these sellers based and where do they do business?

- What value is their current network providing them?

- What are their challenges in the business?

- Are they facing difficulties in expansion?

- Do they use any software tools to improve their process?

- Who are these buyers?

- What is the ideal buyer profile?

- What do they buy and how often do they buy?

- How do they buy goods today?

- What is the % distribution of pure buyers vs buyers + sellers?

- What are the challenges they face in procuring the goods?

- What challenges do they have when it comes to pricing of the goods?

- Do they use any tools to make buying decision and/or improve their process?

- Do they wish to buy from new sellers in different regions?

- Know more about the market itself

- How big is the market and what is the potential?

- What are the growth opportunities?

- Are there opportunities to expand in category or geography or something else?

During this initial discovery phase, you may need data from both primary and secondary sources. This means if you have access to the sellers and buyers, talk to them! Else you can rely on readily available data from companies who may have done this research before.

Understand the core value proposition of the platform

- Ask this “What core need of these sellers and buyers is the platform satisfying?”

- Identify the journey of the seller and the buyer. Put a pin on a potential opportunity as you do this.

- Does the platform have competitors? (If yes, just note them as threats. This is not an issue but it is good to be aware of).

- Are there other platforms with exact same solution?

- If yes, what do they offers?

- If no, why has anyone not done this before? Is that a risk to be aware of?

- Are there other platforms with exact same solution?

- If the product is already built, then how does the flow look like? If it is not built then draw out the ideal journey of the customer on the platform on a whiteboard.

- What part of the product the customer cannot live without? Knowing this will help the team focus on the right things.

- If this platform did not exist, what were their current alternatives? Do they use only their existing network and nothing else?

Describe the pricing strategy and the model

This is where you will put your knowledge from the product discovery phase to use. By now, you would have identified the customer’s problems, platform’s value proposition and the growth opportunities.

It is time to propose!

Option 1: You could say, we should “Charge the Seller” {Who to charge?} a “% commission on each transaction.” {How to charge}

OR

Option 2: You could also say, we should “Charge the Seller and the Buyer” a “% commission on each transaction.” {How to charge}

This is not the only way to do pricing but whatever you choose to propose should be backed up with hypotheses. This brings me to the next section.

State the hypotheses and validation methods

Let’s take Option 1 → Seller is charged % commission per completed transaction.

Following are my hypotheses:

Why charge the Sellers?

- Sellers find value in the marketplace and are able to sell goods at a better price because of data-driven insights and recommendations of Narnia.

- Sellers are able to discover new demand and have the potential to expand their business to new regions.

Why not charge Buyers?

- Driving demand on the marketplace is crucial for initial phase to get the wheel running, and charging buyer would create an entry barrier.

- Buyer’s core need is to look for the cheapest and most valuable product versus seller’s core need is to get rid of the supply; unsold supply is often costly to maintain.

- Charging buyers will be difficult to scale because it needs huge volume of buyers to make money.

Why this pricing model?

- Narnia can scale their profits with Seller’s transactions growth.

- Sellers will have a lower barrier to entry because of no prior commitment to pay.

- Sellers are incentivised to engage with the platform before committing to pay; e.g. listing supply.

Other model:

- We could explore Subscription or fixed cost based model. However, I feel it will limit the potential of Narnia in earning more despite the Seller’s transaction growth.

If you think about it, successful marketplaces like Amazon often charge the Seller on the platform and not the buyer. However, there are marketplaces that charge both seller and the buyer.

Now for each of these hypotheses, I added validations. Validations had quantitative and qualitative methods.

Think about it. You suggested that we should charge the seller and not the buyer. Which performance indicators can be monitored to determine whether the pricing strategy works or not.

Here is an example:

Hypothesis: Sellers find value in the marketplace and are able to sell goods at a better price.

Indicators: Increase in new and repeat transactions, Able to sell at better price.

Validation

Quantitative data:

a) Analyse the transactions and find the delta between the listed price, bidding price, Narnia recommended price and actual selling price of the goods. The % difference should indicate if sellers got more or less price for goods than expected.

b) Track growth in new and repeat transactions for each seller. Ideally, there should be upward trend.

Qualitative data:

Gather subjective inputs as much as possible by interviewing every customer and ask if they find valuable to be on the marketplace and what more do they expect.

I had more hypotheses and validations which I have not purposely listed in this blog else it will be too big. You get the picture.

Document the threats and risks to your model

- In which scenario is the pricing model likely to fail?

- What can cause the drop in transactions?

- Will customers prefer another pricing model? Do we have feedback from the customers to make us think in entirely different direction?

- Is the pricing strategy not aligned with the business strategy?

An example of one such risk: Commission model will make money only when there are substantial number of transactions, Narnia may make money only in the long run, not immediately.

It is hard to say if this strategy will work or not. Much of Product Manager’s work is dependent on the company and its context. I am currently researching on ways to test my pricing strategy framework and do it myself. Your ideas are welcome.