We have come a long way from getting INR 10 cash from our mothers for Parle-G biscuit to making payment with single clicks on our phone.

Cash was the only mode of payment in India — until we saw mass adoption of new technology and mobile phones.

In India, we see new payment app released almost every month. While UPI payments had accelerated the digital payments space, there are several other modes of digital payments.

Since 2016, I have worked in 5 Fintech companies across payment gateways, global money transfers and prepaid cards. In this blog, we’ll explore various payment modes available in India.

- Bank account to Bank Account Transfer (e.g. NEFT)

- Cards (Debit, Credit and Prepaid)

- UPI

- Digital Wallets

- Pay Later

Bank Account to Bank Account Transfer

This mode of payment lets you send the money directly from your bank account to another bank account. NEFT, RTGS, IMPS fall under this category.

In order to transfer money, you will need the full Bank Account details of the receiver like Account Number, Account Name, Bank Name, IFSC code and Branch Name.

They work well when you have to transfer large amounts. This method is very popular when businesses have to pay for big invoices.

However, it is highly inconvenient on online shopping sites or anything that demands instant payment confirmation to both sellers and buyers.

Another drawback is that receiver may not always get the sender’s details. While some banks have tried to improve this, a lot of banks have not.

Through IMPS you can send the money instantly, while NEFT and RTGS could take longer.

NetBanking

Netbanking emerged as an intermediate choice to make a payment. I’d like to think of it as a choice in between NEFT and Card.

This is how it works, if you are on a shopping site and you chose Netbanking, you are redirected to an authentication page. This is where you will either enter your password or OTP and then the payment is successful. You need not know seller’s bank account details. It is a step up from Bank to Bank transfer. It works only if you have a bank account and sufficient money in it.

One of the limitations is that not all banks support this payment method.

Cards

There are 3 types of cards:

- Debit

- Credit

- Prepaid — Debit cum Credit

They come in a plastic or metal form. You can get a card either from your bank or any financial institute like American Express. Cards add a lot more convenience when compared to above 2 choices for payments.

They come with controls like payment limits, blocking a card and changing PINs when required. While cards are issued by the banks, a card network provider like Rupay, Mastercard, Visa, Maestro is required. These Card Networks act as intermediate layer between Merchant’s bank, your bank and you.

Card Networks and banks work together towards fraud prevention and consumer protection. Because they offer these services, Card networks charge a certain fee on each transaction to the merchant. Depending on the fees sellers can choose which card to allow and which to avoid. You will notice American Express is not widely accepted at retail stores.

All cards issued in India will work in India but for international payments, you might have to contact your bank. While many banks have made it easy in their apps, other banks still operate in traditional way.

Debit Card

Debit card is connected to your bank account. It works only if you have sufficient money in your bank account. And this is the key difference between your debit card and credit card. I will explain Credit Cards next.

Many banks issue Debit cards free of cost when you open a bank account. It lets you pay at stores, online sites with ease. You can also control spends by setting up payment limits.

Credit Card

It’s in the name, it is a credit. Imagine getting a loan for 45 days without any interest. You get a certain limit, say INR 1,00,000. You can spend upto 1 Lac and pay the bill later. Of course, if you cannot pay that bill, you will be charged fees for the late payment. This is usually considered risky payment method because you may be tempted to pay more than you can afford.

People are attracted to Credit cards because they offer some rewards. The more you spend, the more rewards you get. Rewards are usually in the form of points which can then be redeemed.

Banks are quick to give out Credit cards with lower limits like INR 10,000 to INR 25,000 to masses. However, to get higher limits like INR 1,00,000+ requires certain income. Some banks also assess your spending capacity and your payment history. If you had missed credit card bill payments in the past, you are less likely to get higher limits.

Paying credit card bills is also easy. You can directly pay from your bank application or use apps like Cred.

Prepaid Cards — Debit cum Credit

You will have to know some technicality to understand this payment method and why it is used. This type of card behaves like a Credit Card but does not have credit limit.

A card has 16 digits card number. They are either printed on the card or shown in the mobile app. The first 6 digits of the card number is called BIN (Bank Identification Number). It helps identify the type of card. Numerous websites accept only Credit cards but not Debit cards. Debit cum Credit card solves this problem. They offer you a Card that acts as Credit Card but you will have to load money onto it. You can only spend what you have loaded. It is the BIN that identifies this card as Credit card.

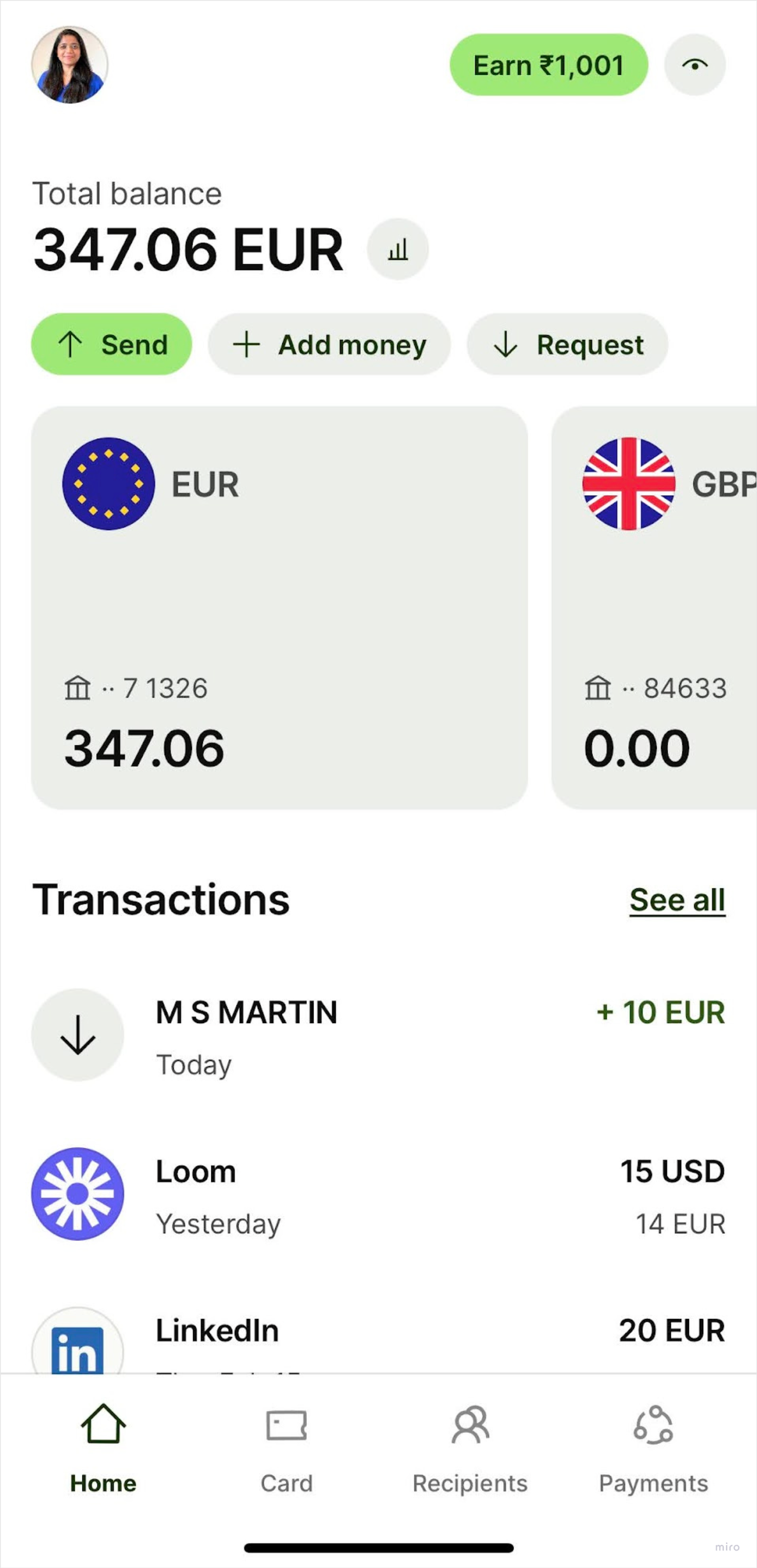

Niyo, Happay are couple of examples in India. Banks also directly offer Prepaid cards. Globally, apps like Wise, Revolut and Monzo are very popular.

I did a case study on Wise where I go in-depth about their UX

(Check it out here).

In the screenshot, EUR 347.06 is the amount I can spend using my Wise prepaid card.

Since they offer less risk to both banks and customers, while also solving a core need, prepaid cards became extremely popular in many countries.

UPI

Unified Payment Interface, or UPI has become a household name. Your grandparents might be already using it. It is used for peer to peer and peer to merchant payments.

When it was first launched, you needed a UPI virtual address to send or receive payment. Nowadays, you only need phone number of the person. In the background, every user gets a virtual private address something like 99XXXXXXX@kotakbank to identify the unique user. UPI is always linked to your bank account which is also linked to the phone number.

You do need a bank account to use UPI. Each bank might have different limits to send and receive money.

As soon as banks adopted it, companies like Paytm, Phonepe, Bharatpe, Google Pay capitalised on the opportunity to make it easy for the merchants to receive payments via QR code.

While UPI works beautifully for small payment amounts, NEFT and Cards are still the go-to choice for large sum of money.

A simple google search should help you understand the scale of this technology and how it became a huge success. It’s an incredible story from digital India.

There is another category of payments that you might have come across. These payment methods still use your bank account but they have different flavours.

Digital Wallets

Products like Paytm and Phonepe have popularised this type of payment method already. Almost every B2C product seems to offer “Wallet.”

I will skip the technicality on how these Wallets are actually created and how they work in background.

In order to use the Wallets, you first have to load the amount from your bank account. Usually, there is a limit between INR 10,000 to INR 20,000. Every month, you can load that amount and use it to make payment. To avail higher limits, you have to complete KYC within these apps.

Products use Wallet as a hook to retain customers. For example, when you order food on Swiggy, they can give you some discount if you use their wallet. You will be tempted to load money in order to avail this discount.

Wallets were very popular before UPI. You could transfer money from your wallet in Paytm to someone else’s Paytm wallet. It facilitated peer to peer transactions easily.

Pay Later

This is similar to how your shopkeeper in the neighbourhood used to give you “udhaar” or credit. When you shop online, you can choose to pay the amount later within X number of days. The number of days depend on multiple factors. Typically, you will see 30, 45 or 60 days. Lazypay is an example for Pay Later option. In Europe, Klarna Pay Later is quite popular. You will also be charged some interest amount.

The biggest risk is the non-payment. Many people can buy once and never pay back. When companies offer this choice, they usually allocate a budget for such risky transactions.

Another factor is, collection. Your neighbourhood shopkeeper can show up at your house but these companies cannot trace you easily. You will receive many calls but it’s easy to buy a sim card and discard it.

If you found this interesting, you might be interested in a case study on UX of Indian & Dutch bank mobile app, check here.

Also, don’t miss Swiggy (Indian) vs JustEatTakeaway(Dutch) case study. See here.

Leave a comment